import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from sklearn.preprocessing import StandardScaler

from sklearn.decomposition import PCA

from sklearn.cluster import KMeans

import seaborn as snsDANL 320 Project

title: "Assesing Credit Risk with Machine Learning"

author: "Daniel Noone & Emily Peters"

date: 2025-05-14

categories: ['Machine Learning', 'Project']cr = pd.read_csv("https://raw.githubusercontent.com/dannoone/dannoone.github.io/refs/heads/main/Data/credit_risk_bench.csv")

cr| rev_util | age | late_30_59 | debt_ratio | monthly_inc | open_credit | late_90 | real_estate | late_60_89 | dependents | dlq_2yrs | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.006999 | 38.0 | 0.0 | 0.302150 | 5440.0 | 4.0 | 0.0 | 1.0 | 0.0 | 3.0 | 0 |

| 1 | 0.704592 | 63.0 | 0.0 | 0.471441 | 8000.0 | 9.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0 |

| 2 | 0.063113 | 57.0 | 0.0 | 0.068586 | 5000.0 | 17.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0 |

| 3 | 0.368397 | 68.0 | 0.0 | 0.296273 | 6250.0 | 16.0 | 0.0 | 2.0 | 0.0 | 0.0 | 0 |

| 4 | 1.000000 | 34.0 | 1.0 | 0.000000 | 3500.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 16709 | 1.000000 | 46.0 | 0.0 | 170.398010 | 401.0 | 3.0 | 2.0 | 0.0 | 0.0 | 2.0 | 1 |

| 16710 | 1.135552 | 41.0 | 2.0 | 0.845887 | 7500.0 | 12.0 | 0.0 | 4.0 | 1.0 | 0.0 | 1 |

| 16711 | 0.920107 | 31.0 | 1.0 | 0.176732 | 1125.0 | 4.0 | 1.0 | 0.0 | 0.0 | 0.0 | 1 |

| 16712 | 0.983825 | 55.0 | 0.0 | 0.064116 | 4600.0 | 2.0 | 1.0 | 0.0 | 0.0 | 6.0 | 1 |

| 16713 | 0.224711 | 55.0 | 0.0 | 0.057235 | 8700.0 | 7.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1 |

16714 rows × 11 columns

cr_agg = cr

cr_agg['total_late'] = cr_agg['late_30_59'] + cr_agg['late_60_89'] + cr_agg['late_90']

cr_agg = cr_agg.drop(columns = ['late_30_59','late_60_89','late_90'])

cr_agg| rev_util | age | debt_ratio | monthly_inc | open_credit | real_estate | dependents | dlq_2yrs | total_late | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.006999 | 38.0 | 0.302150 | 5440.0 | 4.0 | 1.0 | 3.0 | 0 | 0.0 |

| 1 | 0.704592 | 63.0 | 0.471441 | 8000.0 | 9.0 | 1.0 | 0.0 | 0 | 0.0 |

| 2 | 0.063113 | 57.0 | 0.068586 | 5000.0 | 17.0 | 0.0 | 0.0 | 0 | 0.0 |

| 3 | 0.368397 | 68.0 | 0.296273 | 6250.0 | 16.0 | 2.0 | 0.0 | 0 | 0.0 |

| 4 | 1.000000 | 34.0 | 0.000000 | 3500.0 | 0.0 | 0.0 | 1.0 | 0 | 1.0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 16709 | 1.000000 | 46.0 | 170.398010 | 401.0 | 3.0 | 0.0 | 2.0 | 1 | 2.0 |

| 16710 | 1.135552 | 41.0 | 0.845887 | 7500.0 | 12.0 | 4.0 | 0.0 | 1 | 3.0 |

| 16711 | 0.920107 | 31.0 | 0.176732 | 1125.0 | 4.0 | 0.0 | 0.0 | 1 | 2.0 |

| 16712 | 0.983825 | 55.0 | 0.064116 | 4600.0 | 2.0 | 0.0 | 6.0 | 1 | 1.0 |

| 16713 | 0.224711 | 55.0 | 0.057235 | 8700.0 | 7.0 | 0.0 | 0.0 | 1 | 0.0 |

16714 rows × 9 columns

Background

Analyzing credit risk involves determining if a certain borrower will be able to pay off a loan or credit line within the expected time. Banks cannot just simply hand out loans to whoever needs one because it is not guaranteed that the borrower will pay it back. As consumers, we want our banks making very informed decisions, backed by data, on who to give out loans to since we depend on them to handle our money. For banks, identifying borrowers who will potentially commit delinquency allows them to set different interest rates for this type of borrower or even deny the loan altogether which leaves more money for loans that are less risky, potentially increases profits, and therefore helps the bank remain financially stable. With machine learning technologies that are always improving paired with the constant collection of data, banks can use this to their advantage when making tough decisions about loan approvals.

Problem

Giving out loans that can’t be paid back need to be minimized, but qualifications shouldn’t be so strict that it makes getting a loan extremely difficult for financially responsible borrowers. Banks need to find the right balance so they’re not losing money, but they’re not turning away good customers either.

Objective

The goal of this project is to execute machine learning models that can predict if a borrower will be able to repay a loan on time based on the borrower’s financial history. These models should be able to accurately find the differences between borrowers who make payments on time and those who do not, so banks can make sound lending decisions.

Data Description

Our data came from kaggle.com here

It was created to help compare different machine learning models for binary classification. The borrowers in this dataset are determined to have committed delinquency or not within two years.

Variables

Variable Description:

rev_util: revolving credit utilization ratio; The ratio of your credit usage compared to the credit that is availableagemonthly_inc: monthly incomelate_30_59: count of each time the borrower made a late payment within 30-59 days after the due datelate_60_89: count of each time the borrower made a late payment within 60-89 days after the due datelate_90: count of each time the borrower made a late payment at least 90 days after the due datedebt_ratio: debt to income/assets ratio (expressed as a percentage)open_credit: count of open credit lines and loansreal_estate: count of real estate credit lines and loansdependents: count of dependents claimed by borrowerdlq_2yrs: Indication of a serious delinquency occuring within 2 years

- 0: No

- 1: Yes

- 0: No

Data Cleaning and Processing

To omit the effect of outliers within the late_* variables, the total_late variable was created to account for all late payments per borrower. This is further explained in the next section under Investigation of Perfect Correlation Among late_* Variables.

Exploratory Analysis

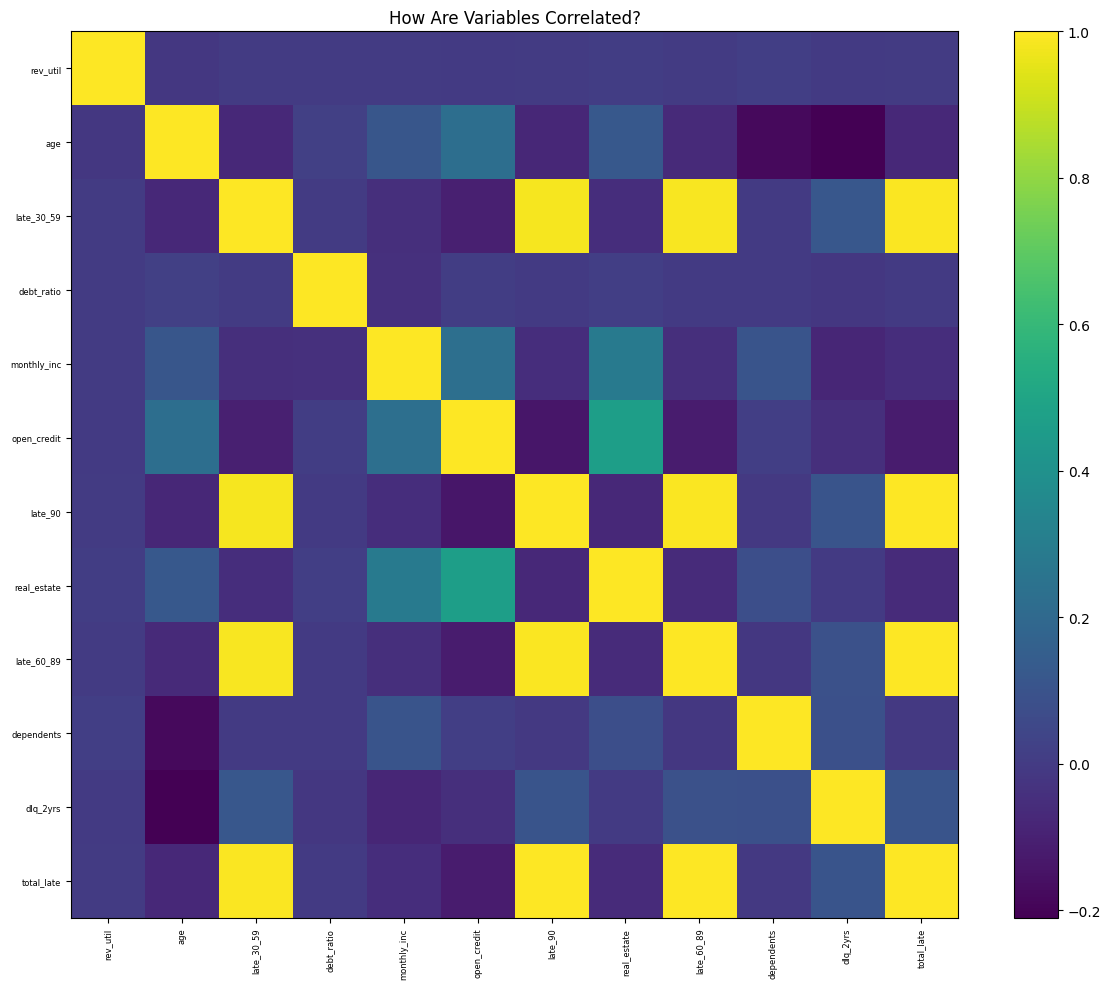

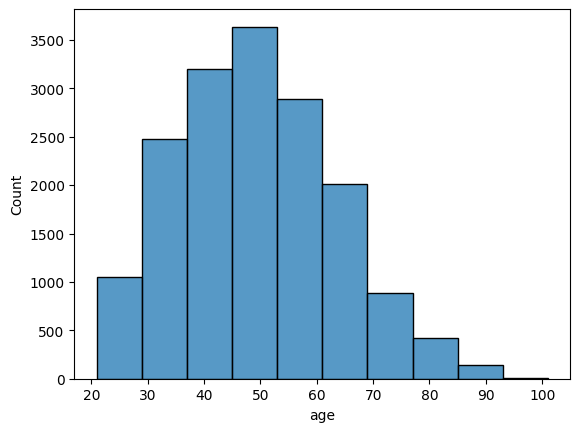

Correlation Heat Map

df_corr = cr.copy()

# Compute correlation matrix

corr_matrix = df_corr.corr()

# 3. Correlation heatmap using matplotlib

fig, ax = plt.subplots(figsize=(12, 10))

cax = ax.imshow(corr_matrix.values, aspect='auto')

fig.colorbar(cax, ax=ax)

ax.set_xticks(range(len(corr_matrix.columns)))

ax.set_yticks(range(len(corr_matrix.columns)))

ax.set_xticklabels(corr_matrix.columns, rotation=90, fontsize=6)

ax.set_yticklabels(corr_matrix.columns, fontsize=6)

plt.title('How Are Variables Correlated?')

plt.tight_layout()

plt.show()

Surprisingly, the three late_* variables are all perfectly correlated. These variables could have such a high correlation because they are each counting the same thing, just in a different time period. It makes sense that a borrower who has fallen behind on a payment will continue to fall behind and make even later payments. This will be investigated further in the next section to determine the true cause. Also, it is important to note that the real_estate and open_credit variables have a strong, positive correlation. This seems correct, as they are both lines of credit, and it is common for an individual to have these different lines simultaneously.

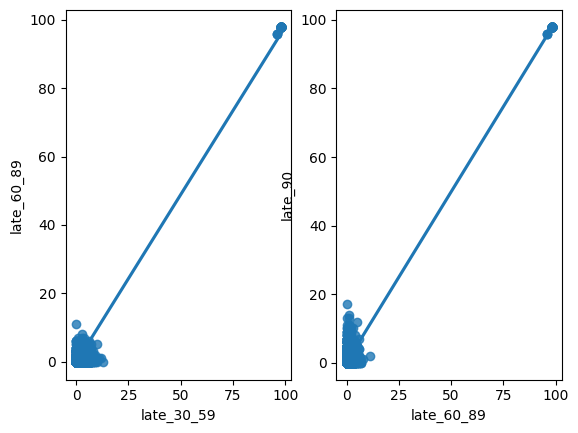

Investigation of Perfect Correlations Among late_* Variables

plt.subplot(1,2,1)

sns.regplot(data = cr, x = 'late_30_59', y = 'late_60_89')

plt.subplot(1,2,2)

sns.regplot(data = cr, x = 'late_60_89', y = 'late_90')

plt.show()

# filtering outliers

cr_filter = cr[(cr['late_30_59'] < 60) & (cr['late_60_89'] < 60) & (cr['late_90'] < 60)]plt.subplot(1,2,1)

sns.regplot(data = cr_filter, x = 'late_30_59', y = 'late_60_89')

plt.subplot(1,2,2)

sns.regplot(data = cr_filter, x = 'late_60_89', y = 'late_90')

plt.show()

The perfect correlations were being caused by extreme outliers in each late_* variable. After filtering out these values, you can see a more accurate representation of the relationships between these variables. It is now clear that the points are more scattered. The variables have positive relationships, but they are far from perfect. As briefly mentioned before, a new variable was created to replace these three late_* variables to help decrease bias in our machine learning models. The new variable, total_late, includes the sum of all late payments made by each borrower.

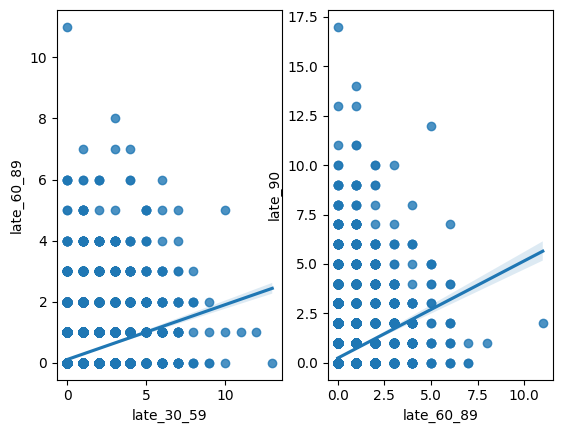

Age Distribution

sns.histplot(data = cr, x = 'age', bins = 10)

To get a better idea of the borrowers in these data, here is the distribution of age. As you can see, most of the borrowers are between the ages of about 37 and 61. The dataset is slightly skewed, as there are some older borrowers included as well, between the ages of about 77 and 101.

Model Motivation

- Logistic Regression: determines relationships if any between feature variables and the binary outcome variable. The Elastic Net model will be used to help prevent overfitting since some feature variables have strong relationships, providing the data with regularization. Elastic Net balances between pushing the coefficients of features that are less important closer to 0 (Lasso Model) and grouping correlated features together (Ridge Model).

- Random Forest: helps predict the binary outcome variable by creating multiple decision trees from bootstrap samples (random samples taken with replacement) from training data. The final tree is constructed through averaging all of the trees together. Using multiple subsets within the training data helps reduce overfitting.

Machine Learning Analysis

For our analyses we chose to apply an elastic net regularized logistic regression and a multi-layer perceptron for binary classification purposes > The target variable here is dlq_2yrs: indication of a serious delinquency occuring within 2 years (essentially risky/non risky borrower)(1/0)

from sklearn.model_selection import train_test_split

import numpy as np

features = ['rev_util', 'age', 'debt_ratio', 'monthly_inc', 'open_credit', 'real_estate' , 'dependents', 'total_late']

X = np.array(cr_agg[features])

m,n = X.shape

y = np.array(cr_agg['dlq_2yrs']).reshape(m, 1)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.25, random_state = 45)

print(f'X_train: {X_train.shape}, {round(X_train.shape[0]/m * 100,2)}%\ny_train: {y_train.shape}, {round(y_train.shape[0]/m * 100,2)}%\nX_test: {X_test.shape}, {round(X_test.shape[0]/m * 100,2)}%\ny_test: {y_test.shape}, {round(y_test.shape[0]/m *100,2)}%')X_train: (12535, 8), 75.0%

y_train: (12535, 1), 75.0%

X_test: (4179, 8), 25.0%

y_test: (4179, 1), 25.0%Elastic Net Logistic Regression

Parameters:

- Cs = 10: goes through ten different values of regularization strength - cv = 5: 5-fold Cross Validation - L1_ratios = [.5, .7, .9]: provides different L1 ratios to choose the best one. Determines how heavily Lasso Regularization is used. - max_iter = 1000: sets the iteration count to 1000 - scoring = ‘neg_log_loss’: sets Cross Validation performance metric to the deviance

from sklearn.linear_model import LogisticRegressionCV

enet_cv = LogisticRegressionCV(

Cs=10, cv=5, penalty='elasticnet', solver='saga',

l1_ratios=[0.5, 0.7, 0.9], max_iter=1000, scoring='neg_log_loss'

)

enet_cv.fit(X_train, y_train)/usr/local/lib/python3.11/dist-packages/sklearn/utils/validation.py:1408: DataConversionWarning: A column-vector y was passed when a 1d array was expected. Please change the shape of y to (n_samples, ), for example using ravel().

y = column_or_1d(y, warn=True)

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(

/usr/local/lib/python3.11/dist-packages/sklearn/linear_model/_sag.py:348: ConvergenceWarning: The max_iter was reached which means the coef_ did not converge

warnings.warn(LogisticRegressionCV(cv=5, l1_ratios=[0.5, 0.7, 0.9], max_iter=1000,

penalty='elasticnet', scoring='neg_log_loss',

solver='saga')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

LogisticRegressionCV(cv=5, l1_ratios=[0.5, 0.7, 0.9], max_iter=1000,

penalty='elasticnet', scoring='neg_log_loss',

solver='saga')print("Elastic Net Regression - Best C:", enet_cv.C_[0])

print("Elastic Net Regression - Best l1 ratio:", enet_cv.l1_ratio_[0])

intercept = float(enet_cv.intercept_)

coef_enet = pd.DataFrame({

'predictor': features,

'coefficient': list(enet_cv.coef_[0])

})

print("Elastic Net Regression Coefficients:")

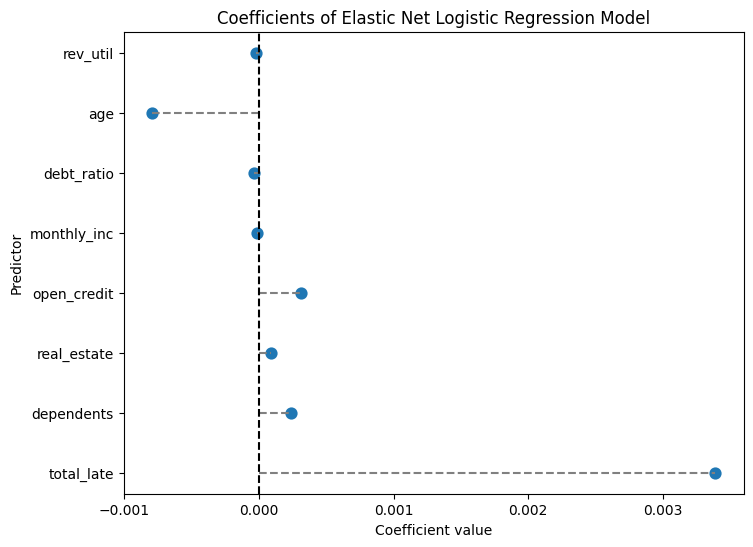

print(coef_enet)Elastic Net Regression - Best C: 10000.0

Elastic Net Regression - Best l1 ratio: 0.9

Elastic Net Regression Coefficients:

predictor coefficient

0 rev_util -0.000025

1 age -0.000795

2 debt_ratio -0.000034

3 monthly_inc -0.000012

4 open_credit 0.000311

5 real_estate 0.000090

6 dependents 0.000237

7 total_late 0.003390DeprecationWarning: Conversion of an array with ndim > 0 to a scalar is deprecated, and will error in future. Ensure you extract a single element from your array before performing this operation. (Deprecated NumPy 1.25.)

intercept = float(enet_cv.intercept_)# Force an order for the y-axis

order = coef_enet['predictor'].tolist()

plt.figure(figsize=(8,6))

ax = sns.pointplot(x="coefficient", y="predictor", data=coef_enet, order=order, join=False)

plt.title("Coefficients of Elastic Net Logistic Regression Model")

plt.xlabel("Coefficient value")

plt.ylabel("Predictor")

# Draw horizontal lines from 0 to each coefficient.

for _, row in coef_enet.iterrows():

# Get the y-axis position from the order list.

y_pos = order.index(row['predictor'])

plt.hlines(y=y_pos, xmin=0, xmax=row['coefficient'], color='gray', linestyle='--')

# Draw a vertical line at 0.

plt.axvline(0, color='black', linestyle='--')

plt.show()UserWarning:

The `join` parameter is deprecated and will be removed in v0.15.0. You can remove the line between points with `linestyle='none'`.

ax = sns.pointplot(x="coefficient", y="predictor", data=coef_enet, order=order, join=False)

This model heavily favored the Lasso Regularization, indicated both by the best L1 ratio; .9, and by the coefficients for each feature; extremely close to 0. This model shows that the biggest influences on borrowers committing a financial delinquency are total_late (.003) and age (-.001). To check the performance of the model, refer to the confusion matrix.

from sklearn.metrics import (confusion_matrix, accuracy_score, precision_score,

recall_score, roc_curve, roc_auc_score)

# Prediction and evaluation for elastic net model

y_pred_prob_enet = enet_cv.predict_proba(X_test)[:, 1]

y_pred_enet = (y_pred_prob_enet > 0.5).astype(int)

ctab_enet = confusion_matrix(y_test, y_pred_enet)

accuracy_enet = accuracy_score(y_test, y_pred_enet)

precision_enet = precision_score(y_test, y_pred_enet)

recall_enet = recall_score(y_test, y_pred_enet)

print("Confusion Matrix (Elastic Net):\n", ctab_enet)

print("Elastic Net Accuracy:", accuracy_enet)

print("Elastic Net Precision:", precision_enet)

print("Elastic Net Recall:", recall_enet)Confusion Matrix (Elastic Net):

[[2081 1]

[2075 22]]

Elastic Net Accuracy: 0.5032304379038047

Elastic Net Precision: 0.9565217391304348

Elastic Net Recall: 0.010491177873152123The model performed very well when it comes to classifying borrowers who have not committed a financial delinquency, with only one false positive. However, there are over two thousand false negative predictions. This means that borrowers who committed financial delinquency were classified as non-delinquent. Out of all delinquent borrowers, the model was only able to correctly identify 22 borrowers, so the model has an extremely low recall rate. Precision is quite high, due to the very low number of borrowers who were classified as likely to commit financial delinquency. As expected with low numbers of correct predictions, accuracy is lower than it should be.

Random Forest

Parameters: - max_features = 3: 3 features will be randomly chosen at each split - n_estimators = 500: size of the ‘forest’ - random_state = 42: seed for random selection - oob_score = True: out-of-bag score estimates error

from sklearn.metrics import mean_squared_error

from sklearn.ensemble import RandomForestRegressor

from sklearn.model_selection import GridSearchCV

import xgboost as xgb

from xgboost import XGBRegressor, plot_importance

from sklearn.inspection import PartialDependenceDisplay# Build the Random Forest model

# max_features=13 means that at each split the algorithm randomly considers 13 predictors.

rf = RandomForestRegressor(max_features=3, # Use 13 features at each split

n_estimators=500, # Number of trees in the forest

random_state=42,

oob_score=True) # Use out-of-bag samples to estimate error

rf.fit(X_train, y_train.ravel()) # Using ravel to change the shape of y_train. This was suggested after receiving a DataConversionWarning

# Print the model details

print("Random Forest Model:")

print(rf)

# Output the model details (feature importances, OOB score, etc.)

print("Out-of-bag score:", rf.oob_score_) # A rough estimate of generalization error

# Generate predictions on training and testing sets

y_train_pred = rf.predict(X_train)

y_test_pred = rf.predict(X_test)

# Calculate Mean Squared Errors (MSE) for both sets

train_mse = mean_squared_error(y_train, y_train_pred)

test_mse = mean_squared_error(y_test, y_test_pred)

print("Train MSE:", train_mse)

print("Test MSE:", test_mse)Random Forest Model:

RandomForestRegressor(max_features=3, n_estimators=500, oob_score=True,

random_state=42)

Out-of-bag score: 0.3473839318930291

Train MSE: 0.02215130147586757

Test MSE: 0.15579227566403447Refining Random Forest Model

# Define the grid of hyperparameters:

# - min_samples_leaf is the minimum number of samples in a terminal node.

param_grid = {

"max_features": list(range(3, 15, 2)),

"min_samples_leaf": [5]

}

# Initialize the RandomForestRegressor:

# - n_estimators is set to 50 (equivalent to num.trees)

# - random_state is set for reproducibility.

# rf = RandomForestRegressor(n_estimators=50, random_state=1917)

rf = RandomForestRegressor(n_estimators=500, # Number of trees in the forest

random_state=42,

oob_score=True) # Use out-of-bag samples to estimate error

# Set up 10-fold cross-validation and GridSearch over the parameters

grid_search = GridSearchCV(

estimator=rf,

param_grid=param_grid,

cv=10,

scoring="neg_mean_squared_error",

return_train_score=True,

n_jobs=-1,

verbose=1

)

# Fit the grid search on the data

grid_search.fit(X_train, y_train.ravel())

# Extract the best parameters

print("Best Parameters:", grid_search.best_params_)

# To replicate the ggplot visualization from R, we plot the grid search results.

results = pd.DataFrame(grid_search.cv_results_)

plt.figure(figsize=(8, 6))

plt.errorbar(

results["param_max_features"].astype(int),

-results["mean_test_score"],

yerr=results["std_test_score"],

fmt="o-",

capsize=5

)

plt.title("Grid Search CV Results")

plt.xlabel("max_features (mtry equivalent)")

plt.ylabel("Mean Squared Error")

plt.grid(True)

plt.show()Fitting 10 folds for each of 6 candidates, totalling 60 fits

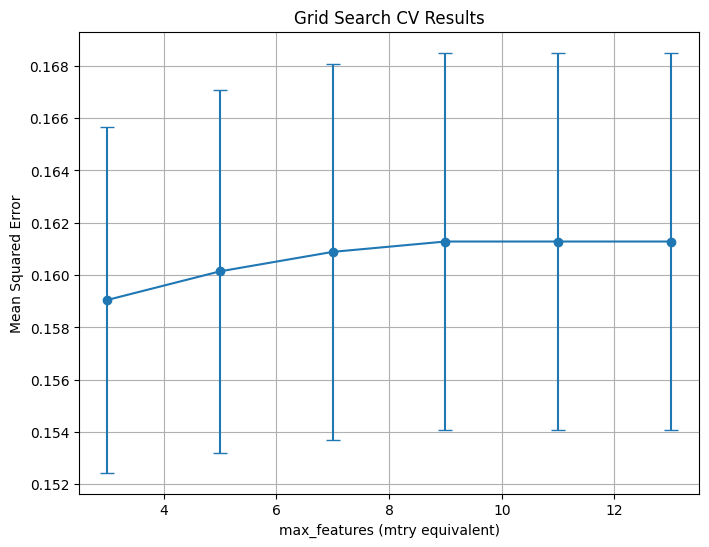

Best Parameters: {'max_features': 3, 'min_samples_leaf': 5}

The model performed well on the training data since the training MSE is very low, but this model could use some further refining as the test MSE is slightly larger, suggesting some overfitting. The out-of-bag score indicates that 34.74% of the out-of-bag sample was predicted correctly, which is not very high. After setting up and fitting a Grid Search on the training data, it was concluded that the optimal max_features is 3. When the max_features are set to 3, the test MSE is the lowest compared to other max_feature values. Through refining the Random Forest model, we are able to find the most important variables, rev_utils and total_late, which slightly differ from the biggest weights assigned by the previous logistic regression model.

PCA and Cluster Analysis

features = ['rev_util', 'total_late','debt_ratio', 'open_credit', 'real_estate','dependents', 'dlq_2yrs']

cr = cr_agg

scaler = StandardScaler()

X_scaled = scaler.fit_transform(cr[features])

pca = PCA()

X_pca = pca.fit_transform(X_scaled)Scree Plot

plt.figure(figsize=(8, 4))

plt.plot(range(1, len(features) + 1), pca.explained_variance_ratio_, marker='o')

plt.title('Scree Plot')

plt.xlabel('Principal Component')

plt.ylabel('Variance Explained')

plt.grid(True)

plt.show()

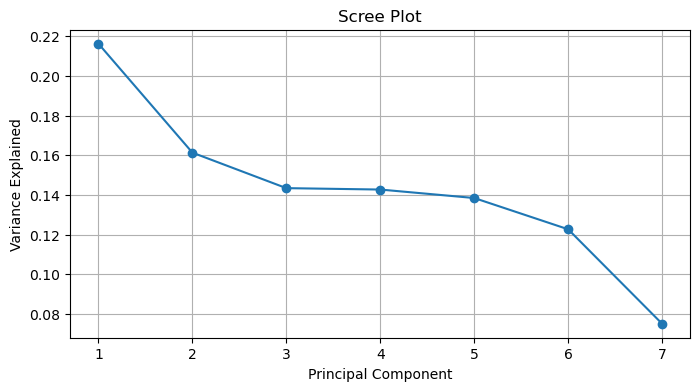

The scree plot for our PCA analysis shows that ~38% of the total variance is explained by the first two principal components.

Cluster Analysis

pca_2 = PCA(n_components=2)

X_pca_2 = pca_2.fit_transform(X_scaled)

kmeans = KMeans(n_clusters=3, random_state=42)

clusters = kmeans.fit_predict(X_pca_2)

cr['cluster'] = clusters

plt.figure(figsize=(8, 6))

sns.scatterplot(x=X_pca_2[:, 0], y=X_pca_2[:, 1], hue=cr['cluster'], palette='Set2')

plt.xlabel('Principal Component 1')

plt.ylabel('Principal Component 2')

plt.title('Cluster Plot on First Two Principal Components')

plt.grid(True)

plt.show()C:\Users\noone\anaconda3\Lib\site-packages\joblib\externals\loky\backend\context.py:136: UserWarning: Could not find the number of physical cores for the following reason:

[WinError 2] The system cannot find the file specified

Returning the number of logical cores instead. You can silence this warning by setting LOKY_MAX_CPU_COUNT to the number of cores you want to use.

warnings.warn(

File "C:\Users\noone\anaconda3\Lib\site-packages\joblib\externals\loky\backend\context.py", line 257, in _count_physical_cores

cpu_info = subprocess.run(

^^^^^^^^^^^^^^^

File "C:\Users\noone\anaconda3\Lib\subprocess.py", line 548, in run

with Popen(*popenargs, **kwargs) as process:

^^^^^^^^^^^^^^^^^^^^^^^^^^^

File "C:\Users\noone\anaconda3\Lib\subprocess.py", line 1026, in __init__

self._execute_child(args, executable, preexec_fn, close_fds,

File "C:\Users\noone\anaconda3\Lib\subprocess.py", line 1538, in _execute_child

hp, ht, pid, tid = _winapi.CreateProcess(executable, args,

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

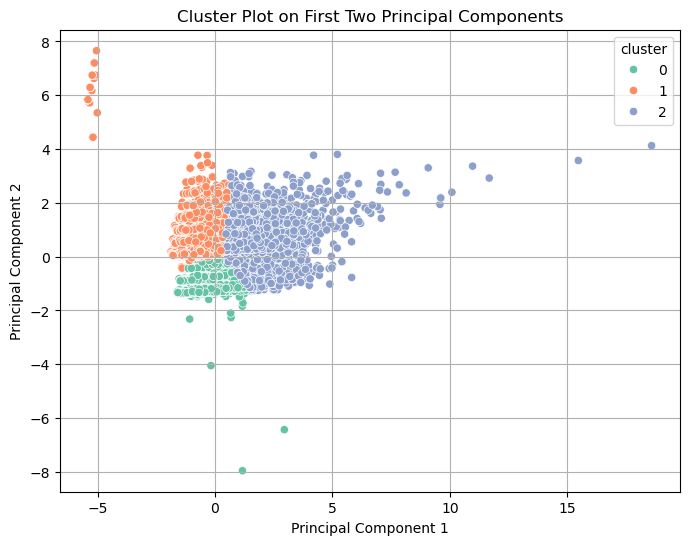

This is a visualization of the KMeans clustering with the first two principal components. There can be seen three distinct clusters which have very distinct boundaries between them. Cluster 0 which is green, is small when compared to the other two and has seemingly fewer outliers. Cluster 1 which is orange is grouped very tightly for the most part. Finally, cluster 2 which is purple is much larger than the other two and is more widespread.

Overall:

- This visualization suggests that there exist meaningful groupings within the credit risk data set.

Multi-Layer Perceptron for Binary Classification

A multi-layer perceptron (MLP) for binary classsification is a form of neural network that takes the role of a classifier deciding between two classes. In this case it is deciding essentially if an individual is risky to lend to or not. The method by which this model was built was by defining multiple user-defined funtions (UDFs) which were then combined into one final training loop. This next section will focus on going over the individual UDFs and how they combine into the final training loop, along with UDFs for performance calculation and predictions. This specific set of UDFs is ONLY for networks with two hidden layers.

> initialize_params

def initialize_params(X, num_units_hidden_1, num_units_hidden_2, ): # He Initialization due to ReLU type activation.

scale1 = np.sqrt(2 / X.shape[1])

W1 = np.random.randn(X.shape[1], num_units_hidden_1) * scale1

scale2 = np.sqrt(2 / num_units_hidden_1)

W2 = np.random.randn(num_units_hidden_1, num_units_hidden_2) * scale2

scale3 = np.sqrt(2 / num_units_hidden_2)

W3 = np.random.randn(num_units_hidden_2, 1) * scale3

b1 = np.zeros((1, num_units_hidden_1))

b2 = np.zeros((1, num_units_hidden_2))

b3 = np.zeros((1,1))

params = {

'W1': W1,

'W2': W2,

'W3': W3,

'b1': b1,

'b2': b2,

'b3': b3

}

return paramsSize of Parameter Matrices

the initialize_params UDF takes a matrix X with shape (m,n) - where m = number of training examples, and n = number of features along with num_units_hidden_1 and num_units_hidden_2 which are integer values describing how many neurons are in each hidden layer. The purpose is to initialize weights and biases for the specific arcitecture needed, and determined by the inputs of the UDF.

In our specific case X has 8 features, 64 neuarons in HL1, and 32 neurons in HL2. So the resulting shapes are as follows:

- W1 : (8,64) - b1 : (1,64)

- W2 : (64,32) - b2 : (1,32)

- W3 : (34,1) - b3 : (1,1)Weights - He Initialization

The weights are random values from a standard normal distribution (np.random.randn()) and scaled using He Initialization which is an appropriate parameter initialization metod for ReLU type activation functions (Leaky ReLU in our case). The goal of using He Initialization is to avoid vanishing or exploding gradients which would lead to slowed/failed training.

### \(scale_i = \sqrt{\frac{2}{n}}\) Where: n = number of features into layer i

Thus, He Initialization here attempts to keep outputs stable across layers when using ReLU type activation functions by multiplying \(Wi\) by \(scale_i\).

Biases

Biases are simply initialized to zeros

Packaging for Future Use

The Weights and Biases are then packaged in a dictionary which is the output of the initialize_params UDF.

> sigmoid, leaky_relu, and forward_prop

def sigmoid(X):

X = np.clip(X, -500, 500) # To prevent overflow

g = 1 / (1 + np.exp(-X))

return g

def leaky_relu(X, alpha_rel):

return np.where(X > 0, X, alpha_rel * X)

def forward_prop(X, params, alpha_rel): # With Leaky ReLU Activation (np.max(alpha*Z,Z))

W1 = params['W1']

W2 = params['W2']

W3 = params['W3']

b1 = params['b1']

b2 = params['b2']

b3 = params['b3']

# Hidden 1

Z1 = np.dot(X, W1) + b1

A1 = leaky_relu(Z1, alpha_rel)

# Hidden 2

Z2 = np.dot(A1, W2) + b2

A2 = leaky_relu(Z2, alpha_rel)

# Output

Z3 = np.dot(A2, W3) + b3

A3 = sigmoid(Z3)

cache = {

'Z1': Z1,

'A1': A1,

'Z2': Z2,

'A2': A2,

'Z3': Z3,

'A3': A3

}

return cacheSigmoid

* To be used in the forward_prop UDF in the output layer to transform pre-activation \(Z^{[3]}\) into probabilites in post-activation \(A^{[3]}\) * Takes as inputs: * X: The pre-activation values of the output layer in the MLP. \[ g(x) = \frac{1}{1 + e^{-x}}\]

Returns the probability that the prediction is 1 Leaky ReLU

* The chosen activation function, which scales values that are less than 0 by a chosen \(\alpha\), to be used in the forward_prop UDF. * Takes as inputs: *X: The pre-activations of the given layer *alpha_rel: Chosen value for \(\alpha\) \[ \text{LeakyReLU}(x) = \begin{cases} x, & \text{if } x \geq 0 \\ \alpha x, & \text{if } x < 0 \end{cases} \] Forward Propagation

* The full forward pass function for the 2 hidden layer MLP. * Takes as inputs: *X: Input data of size m x n *params: Dictionary of parameters originally obtained frominitialize_params*alpha_rel: Chosen value for \(\alpha\) in Leaky ReLU * Loads in the parameters fromparamsand calculates the pre-/post-activations for each layer using Leaky ReLU to find post activations until the output layer while the UDF for sigmoid is used to calculate the probabilized output.

A Look at the forward pass

\(Z_1 = X \cdot W_1 + b_1 \rightarrow\rightarrow\rightarrow A_1 = \text{LeakyReLU}(Z_1)\)

\(Z_2 = A_1 \cdot W_2 + b_2 \rightarrow\rightarrow\rightarrow A_2 = \text{LeakyReLU}(Z_2)\)

\(Z_3 = A_2 \cdot W_3 + b_3 \rightarrow\rightarrow\rightarrow A_3 = \text{Sigmoid}(Z_3) = \hat{y}\)

- Finally, all of the intermediates are stored in a dictionary labeled

cachewhich is returned by the UDF.

binary_cross_entropy

def binary_cross_entropy(y, cache):

m,n = y.shape

epsilon = 1e-12 # To avoid log(0)

y_hat = np.clip(cache['A3'], epsilon, 1 - epsilon) # To avoid log(0) errors

bce = -((y*np.log(y_hat)) + ((1-y)*np.log(1-y_hat)))

cost = np.sum(bce) / m

return costUsed to calculate the cost function \(\mathcal{J}(W,b)\) which is the loss function \(\mathcal{L}(y,\hat{y})\) averaged over all training examples \(m\). * Takes as inputs: * y: The true label data stored in an m x 1 matrix * cache: Results of forward_prop UDF storing intermediates and probabilities in a dictionary

- \(\epsilon\) is defined to be used in the np.clip() of the probabilites \(A_3\), so as to avoid \(\log{(0)}\) errors.

- Binary cross entropy is then calculated…

- \(\mathcal{L} = -\left( y \log(\hat{y}) + (1 - y) \log(1 - \hat{y}) \right)\)

- Then averaged over \(m\) training examples

- \(J = \frac{1}{m} \sum_{i=1}^{m} \mathcal{L}^{(i)}\)

- Cost is then returned by the UDF.

leaky_relu_dv, back_prop, and update_params

def leaky_relu_dv(X, alpha_rel):

return np.where(X > 0, 1, alpha_rel)

def back_prop(X, y, params, cache, alpha_rel):

W1 = params['W1']

W2 = params['W2']

W3 = params['W3']

b1 = params['b1']

b2 = params['b2']

b3 = params['b3']

Z1 = cache['Z1']

Z2 = cache['Z2']

Z3 = cache['Z3']

A1 = cache['A1']

A2 = cache['A2']

A3 = cache['A3']

m,n = X.shape

# Output

dZ3 = A3 - y

dW3 = np.dot(A2.T, dZ3) /m

db3 = np.sum(dZ3, axis = 0, keepdims = True) /m

# Hidden 2

dA2 = np.dot(dZ3, W3.T)

dZ2 = dA2 * leaky_relu_dv(Z2, alpha_rel)

dW2 = np.dot(A1.T, dZ2) /m

db2 = np.sum(dZ2, axis = 0, keepdims = True) /m

# Hidden 1

dA1 = np.dot(dZ2, W2.T)

dZ1 = dA1 * leaky_relu_dv(Z1, alpha_rel)

dW1 = np.dot(X.T, dZ1) /m

db1 = np.sum(dZ1, axis = 0, keepdims = True) /m

gradients = {

'dW3': dW3,

'dW2': dW2,

'dW1': dW1,

'db3': db3,

'db2': db2,

'db1': db1

}

return gradients

def update_params(params, gradients, alpha, clip, clip_value):

if clip == True:

gradients['dW1'] = np.clip(gradients['dW1'], -clip_value, clip_value) # Gradient clipping to avoid exploding gradients

gradients['dW2'] = np.clip(gradients['dW2'], -clip_value, clip_value)

gradients['dW3'] = np.clip(gradients['dW3'], -clip_value, clip_value)

gradients['db1'] = np.clip(gradients['db1'], -clip_value, clip_value)

gradients['db2'] = np.clip(gradients['db2'], -clip_value, clip_value)

gradients['db3'] = np.clip(gradients['db3'], -clip_value, clip_value)

params['W1'] -= gradients['dW1'] * alpha

params['W2'] -= gradients['dW2'] * alpha

params['W3'] -= gradients['dW3'] * alpha

params['b1'] -= gradients['db1'] * alpha

params['b2'] -= gradients['db2'] * alpha

params['b3'] -= gradients['db3'] * alpha

return paramsGradient, Leaky ReLU

* To be used in the back_prop UDF to calculate the derivative of the Leaky ReLU activation function w.r.t its input. * Takes as inputs: * X: Again, the pre-activation value of the layer * alpha_rel: The chosen \(\alpha\) for Leaky ReLU

\[

\text{LeakyReLU}'(x) =

\begin{cases}

1, & \text{if } x \geq 0 \\

\alpha, & \text{if } x < 0

\end{cases}

\] ____ Backpropagation

* Calculates the gradients of \(\mathcal{J}(W,b)\) w.r.t. the Weights and biases to be used in updating the parameters. * Takes as inputs: * X: Input data of size m x n * y: True label data * params: Dictionary of parameters * cache: Dictionary of intermediates and output * alpha_rel: Chosen \(\alpha\) for Leaky ReLU * Loads in parameters from params and intermediates/output from cache and uses them to perform backpropagation to find the gradients.

A look at the backpropagation

_________________________________________________________________________________________________________________________________

Output Layer - \[ \frac{\partial\mathcal{J}}{\partial{Z_3}} = A_3 - y \] \[ \frac{\partial\mathcal{J}}{\partial{W_3}} = \frac{A_2^\top \cdot \frac{\partial\mathcal{J}}{\partial{Z_3}}}{m} \] \[ \frac{\partial\mathcal{J}}{\partial{b_3}} = \frac{\sum_{i=1}^{m}\frac{\partial\mathcal{J}}{\partial{Z_3^{(i)}}}}{m} \] HL2 - \[ \frac{\partial\mathcal{J}}{\partial{A_2}} = \frac{\partial\mathcal{J}}{\partial{Z_3}} \cdot W_3^\top \] \[ \frac{\partial\mathcal{J}}{\partial{Z_2}} = \frac{\partial\mathcal{J}}{\partial{A_2}} \cdot LeakyReLU'(Z_2) \] \[ \frac{\partial\mathcal{J}}{\partial{W_2}} = \frac{A_1^\top \cdot \frac{\partial\mathcal{J}}{\partial{Z_2}}}{m} \] \[ \frac{\partial\mathcal{J}}{\partial{b_2}} = \frac{\sum_{i=1}^{m}\frac{\partial\mathcal{J}}{\partial{Z_2^{(i)}}}}{m} \] HL1 - \[ \frac{\partial\mathcal{J}}{\partial{A_1}} = \frac{\partial\mathcal{J}}{\partial{Z_2}} \cdot W_2^\top \] \[ \frac{\partial\mathcal{J}}{\partial{Z_1}} = \frac{\partial\mathcal{J}}{\partial{A_1}} \cdot LeakyReLU'(Z_1) \] \[ \frac{\partial\mathcal{J}}{\partial{W_1}} = \frac{X^\top \cdot \frac{\partial\mathcal{J}}{\partial{Z_1}}}{m} \] \[ \frac{\partial\mathcal{J}}{\partial{b_1}} = \frac{\sum_{i=1}^{m}\frac{\partial\mathcal{J}}{\partial{Z_1^{(i)}}}}{m} \] _________________________________________________________________________________________________________________________________

* Gradients are then stored in a dictionarygradientswhich is returned for future use ____ Updating Parameters

- Updates the parameters using gradients calculated with back_prop UDF, and provides the option to clip the gradients if needed. - Takes as inputs: -params: Dictionary with the parameters -gradients: Dictionary with gradients from the back_prop UDF -alpha: Chosen learning rate \(\alpha\) -clip: True or False, ifclip ==Truethe UDF will clip the gradients -clip_value: Ifclip == Truethe gradients will be clipped by the value ofclip_value

Basic formula: \[ P_{new} = P_{old} - \alpha \frac{\partial \mathcal{J}}{\partial P_i} \]

- The parameters in the

paramsdictionary are updated with these new adjusted parameters which is what the UDF returns.

training_loop

def training_loop(X, y, alpha, alpha_rel, epochs, clip, clip_value, num_units_hidden_1, num_units_hidden_2):

cost_hist = []

iter_hist = []

dw3_hist = []

dw2_hist = []

dw1_hist = []

db3_hist = []

db2_hist = []

db1_hist = []

params = initialize_params(X, num_units_hidden_1, num_units_hidden_2)

for i in range(epochs):

iter_hist.append(i)

cache = forward_prop(X, params, alpha_rel)

cost = binary_cross_entropy(y, cache)

cost_hist.append(cost)

gradients = back_prop(X, y, params, cache, alpha_rel)

params = update_params(params, gradients, alpha, clip, clip_value)

dw3_hist.append(gradients['dW3'])

dw2_hist.append(gradients['dW2'])

dw1_hist.append(gradients['dW1'])

db3_hist.append(gradients['db3'])

db2_hist.append(gradients['db2'])

db1_hist.append(gradients['db1'])

if i % 50 == 0:

print(f'Epoch: {i}/{epochs} --- --- --- Cost: {cost}')

print('Max dW3:', float(np.max(np.abs(gradients['dW3']))))

print('Mean A2 > 0:', np.mean(cache['A2'] > 0))

print('----------------------------------------------')

gradient_history = {

'dW3': dw3_hist,

'dW2': dw2_hist,

'dW1': dw1_hist,

'db3': db3_hist,

'db2': db2_hist,

'db1': db1_hist,

}

return cost_hist, iter_hist, params, cache, gradients, gradient_history # Returns raw sigmoid output in cache['A3']Full training loop for the MLP.

Performs the forward pass, computes loss/cost, finds the gradients with backpropagation and updates the parameters for a set number of epochs/iterations

Takes as inputs:

X: Training datay: Label dataalpha: Learning ratealpha_rel: Alpha for LeakyReLUepochs: number of epochs/iterations to run forclip: Decide whether or not to clipclip_value: Clip by this muchnum_units_hidden_1: Number of units in hidden layer 1num_units_hidden_2: number of units in hidden layer 2

General Process

- Sets up empty lists to track metrics and gradients

- Parameters are initialized using

initialize_params - For range of epochs:

- Perform forward pass with

forward_prop - Use results from forward_prop to calculate cost using

binary_cross_entropy - Gradients are calculated using

back_prop - Parameters are updated using gradients and learning rate \(\alpha\) using

update_params

- Perform forward pass with

- Parameters are initialized using

- Sets up empty lists to track metrics and gradients

Returns:

- Cost History

- Iterations

- Parameter Dictionary

- Cache Dictionary

- Gradient Dictionary

- Gradient History Dictionary

predict, metrics_compute, and to_binary

def to_binary(y, threshold):

return (y > threshold).astype(int)

def predict(X, params, threshold, alpha_rel):

cache = forward_prop(X, params, alpha_rel)

y_pred = cache['A3']

y_pred_bin = to_binary(y_pred, threshold)

return y_pred, y_pred_bin

def metrics_compute(y_hat, y):

TP = np.sum((y == 1) & (y_hat == 1))

FP = np.sum((y == 0) & (y_hat == 1))

FN = np.sum((y == 1) & (y_hat == 0))

TN = np.sum((y == 0) & (y_hat == 0))

print('+------ Confusion Matrix ------+')

print(f' {TN} {FP} ')

print('|------------------------------|')

print(f' {FN} {TP}')

print('+------------------------------+')

accuracy = (TP + TN) / (TP + TN + FP + FN)

precision = TP / (TP + FP)

recall = TP / (TP + FN)

f1 = (2 * precision * recall) / (precision + recall)

metrics = {

'TP': TP,

'TN': TN,

'FP': FP,

'FN': FN,

'accuracy': accuracy,

'precision': precision,

'recall': recall,

'f1': f1

}

print(f'Accuracy: {accuracy}\nPrecision: {precision}\nRecall: {recall}\nf1-score: {f1}')

return metricsBinary

- UDF simply takes the input and sets it to 1 if greater than threshold, or to 0 if less than threshold

Predict

- This UDF performs a forward pass with forward_prop and returns the probabilities and binarized output.

Metrics

- Calculates many of the metrics necessary to assess a binary classifier. - Calculates metrics and prints out a confusion matrix - Calculates accuracy, precision, recall, and f1-score which is also printed - It returns a dictionary with all of these metrics stored

Results

Below is the confusion matrix for our MLP with a chosen threshold of 0.2, looking into the future it would be beneficial to better tune a proper threshold

+------ Confusion Matrix ------+ 460 1622 |------------------------------| 194 1903 +------------------------------+ Accuracy: 0.5654462790141183 Precision: 0.5398581560283688 Recall: 0.9074868860276586 f1-score: 0.6769832799715404

- It can be seen that accuracy and precision measures are very poor and not much better than random chance.

- Recall on the other hand is too high at ~90.7%

- The f1-score is okay at ~67.7%

What this means:

- The model performs too far one way, it shows too much affinity for predicting that someone will be a risky borrower - This is beneficial if the goal here is to avoid risk at all costs, but in most cases this would be considered poor performance because as much as risk is good to avoid, too many unrisky borrowers were deemed risky.

What could be done better?

- There could be more time spent exploring different architectures such as different numbers of neurons per layer, more or less hidden layers, threshold optimization, different activation functions, and better tuning of hyperparameters such as the learning rate and epochs.

- Doing these things could lead to a very good model that is proficient in predicting credit risk

Business/Real-World Applications

Applications of these models could vary widely and be of great importance in a number of fields. Specifically in terms of credit risk, lenders such as banks could better evaluate whether or not a potential borrower is likely to pay them back or not. It could also be useful in finding out which financial characteristics are most important in deciding if someone is risky to lend to or not. Perhaps it could be applicable to areas such as car sales (or any other sale of a high value item). In these areas a seller who may offer financing could run a potential buyer’s characteristics through a model like these and decide whether or not they’d like to allow financing. The applications of models such as these is not solely in the area of business, applications can exist anywhere where it’s useful to be able to predict between two classes, or, in the case of regularized logistic regression, where it is useful to find how much of an effect a variable has on the target variable. The use cases for these types of models are endless.

Conclusion

Four different machine learning models were used in attempt to accurately predict if a borrower would end up committing a serious financial delinquency witin two years. Although these models are not entirely accurate, they still were able to provide meaningful insights, such as the variables with the most influence on our target variable, as well as predicting deliquent borrowers. However, these predictions were not accurate when it came to predicting good borrowers. If given more time, improvements could be made by hypertuning certain parameters in the models, or addressing the outliers in the late_* variables differenly, like filtering out the outliers and keeping the indiviudal variables instead of summing them up.

References

adilshamim8. (n.d.). Credit Risk Benchmark Dataset [Data set]. Kaggle.

https://www.kaggle.com/datasets/adilshamim8/credit-risk-benchmark-dataset